This year’s election results are in, but there is still a lot to explore before new policy-makers take their places in January. Every election is a pivotal moment for many industries, and this year is no different. With policy changes predicted to be widespread and extensive, there may be far-reaching impacts to the clinical trial industry.

In a recent webinar, featuring clinical trial and healthcare policy leaders, we explored the potential impact of the Trump administration’s policies on the Centers for Medicare & Medicaid Services (CMS) and drug pricing. As the industry faces significant challenges around cost control, patient access, and maintaining innovation incentives, these discussions offered crucial insights into the road ahead.

Panel Overview

Our panelists came from several specialties in the Clinical Research industry, and eEach panelist brought a unique perspective on how policy shifts might influence clinical trials, federal oversight, and the drug development ecosystem.

- Catherine Greger: Chief Clinical Trial Officer at Florence Healthcare.

- Jackie Kent: Independent Advisor with a focus on inclusive clinical research.

- Sophia McLeod: Senior Director of Government Relations at ACRO.

- Casey Orbin: Chief Commercial Officer at Alcanza Clinical.

The Current Landscape of CMS and Drug Pricing CMS’s Expansive Role in Healthcare

CMS is central to the nation’s $4.5 trillion healthcare economy, covering over 160 million people through Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and the Affordable Care Act (ACA). If confirmed by the Senate to lead CMS, Dr. Mehmet Oz would oversee these programs, which serve individuals from newborns to nursing home residents. The agency also plays a key role in setting Medicare payment rates for providers—rates that serve as a foundation for private insurers. Additionally, CMS establishes operational standards for healthcare providers.

With more than 6,000 employees and a $1.1 trillion budget, CMS wields significant influence over healthcare policy and delivery. This vast scope underscores the importance of the agency’s leadership and its alignment with broader federal goals.

Balancing Affordability and Innovation

Patient Access vs. Business Sustainability

Drug pricing has been a central issue in recent years, particularly with the passage of the Inflation Reduction Act (IRA). The Act introduced measures to cap drug prices for Medicare, aiming to improve affordability for patients. However, these caps have created financial challenges for pharmaceutical companies, whose return on investment (ROI) has sharply declined—from 12% in 2005 to just 3% in 2020. This squeeze on margins has already led to record layoffs in the pharmaceutical and contract research organization (CRO) sectors, as well as strategic decisions to limit development pipelines.

The Trump Administration’s Pro-Business Stance

Under the anticipated Trump administration, CMS is expected to adopt policies that emphasize privatization and efficiency. Dr. Oz, a proponent of Medicare Advantage and managed care, has indicated a preference for involving private entities in managing Medicare programs. This approach aims to “business-fy” Medicare by leveraging private sector efficiencies while maintaining patient coverage.

Potential Policy Directions

- Revising the IRA: Rather than a complete repeal, the Trump administration may rebrand and refine IRA provisions to better align with its pro-business objectives.

- Medicare Payment Structures: Adjustments to Medicare’s payment rates could cascade across the healthcare system, impacting private insurers and provider operations.

- Chevron Doctrine Reversal: A Supreme Court challenge to the Chevron Doctrine, which currently allows federal agencies broad latitude in policy-making, could shift more legislative oversight to Congress and affect CMS’s operational scope.

Sophia McLeod helped provide some historical insights into Trump’s first term, referencing the Most Favored Nations (MFN) program, which sought to tie Medicare drug prices to international benchmarks. While the MFN program faced opposition and did not succeed, its principles align with parts of the IRA, suggesting that future policies may adapt rather than abandon these goals.

That said, CMS’s influence extends far beyond payment rates and healthcare coverage. Its policies shape how healthcare providers operate and how clinical trials are integrated into care models. Dr. Oz’s leadership could signal a shift toward private-sector efficiency, but the agency’s foundational role in ensuring equitable access to healthcare remains unchanged.

What’s Next for the Industry?

The panelists emphasized the importance of preparation as the industry faces these policy shifts:

- Understand Managed Care Implications: Analyze how shifts toward managed care could impact clinical trial coverage and patient access.

- Engage in Advocacy: Work with policymakers to ensure research priorities align with broader public health goals.

Adapt to Funding Changes: Prepare for evolving reimbursement models and budget constraints.

Conclusion

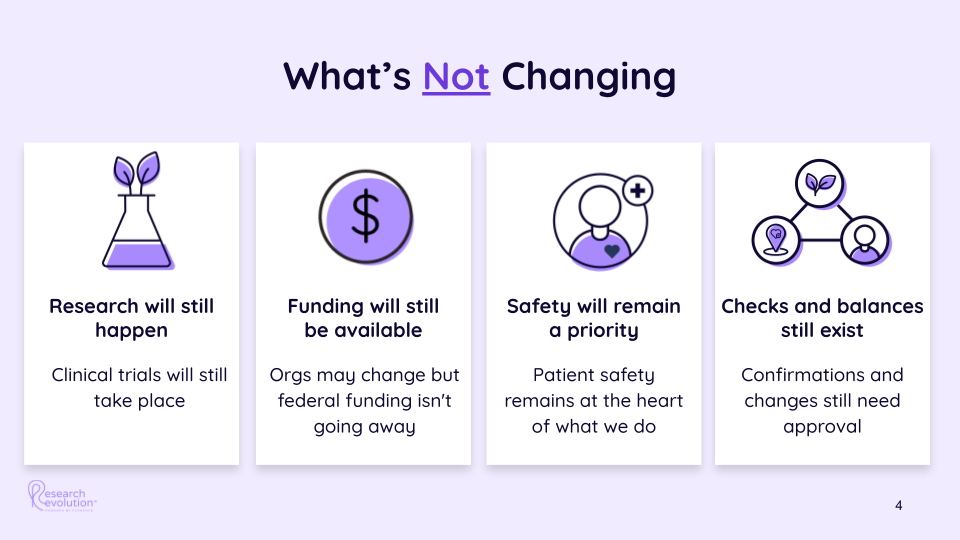

The Trump administration’s approach to CMS and drug pricing will likely blend continuity with targeted reforms. As policies evolve, industry stakeholders must stay informed and agile to navigate the shifting landscape. With CMS’s central role in the healthcare economy, its leadership will have far-reaching implications for clinical trials, patient care, and the broader healthcare system.

Read Next:

You can watch the webinar recording here if you weren’t able to join us live!

Learn more about the importance of CRAs in driving successful change management.

Get the latest on the final DCT Guidance to close out the year with full compliance.

![[11_20] Post Election Insights _ Impact on Clinical Trials Deck White text on purple slide saying](https://researchrevolution.com/wp-content/uploads/2024/12/11_20-Post-Election-Insights-_-Impact-on-Clinical-Trials-Deck-696x392.png)